April 5, 2013, by Graham Kendall

What is Economic Integration?

In this What is? series, we invite experienced researchers to write about their area of research, but in more general terms than they might normally do.

This article, entitled What is Economic Integration?, is written by Dr Camilla Jensen, who is an Associate Professor and Head of School (UNMC) in The School of Economics. Camilla can be contacted at Camilla.Jensen@nottingham.edu.my

If you would like to contribute to this serries, then please let me know (Graham.Kendall@nottingham.edu.my) and we can discuss how best to go about it.

The phenomena

Economic Integration has become a common denominator for the phenomena that in Europe is known as ‘Regional Economic Integration’ – e.g. it is the economic and political process of increasing integration of nation states by removing physical and other barriers to the free movement of goods, services, labour and capital.

Where exactly the idea about Economic Integration originates and starts is hard to establish. The Fathers of European Economic Integration (which took pace especially after the 2nd World War) were the French Statesman Robert Schuman, the American General George C. Marshall and the French Political Economist and Diplomat Jean Monnet.

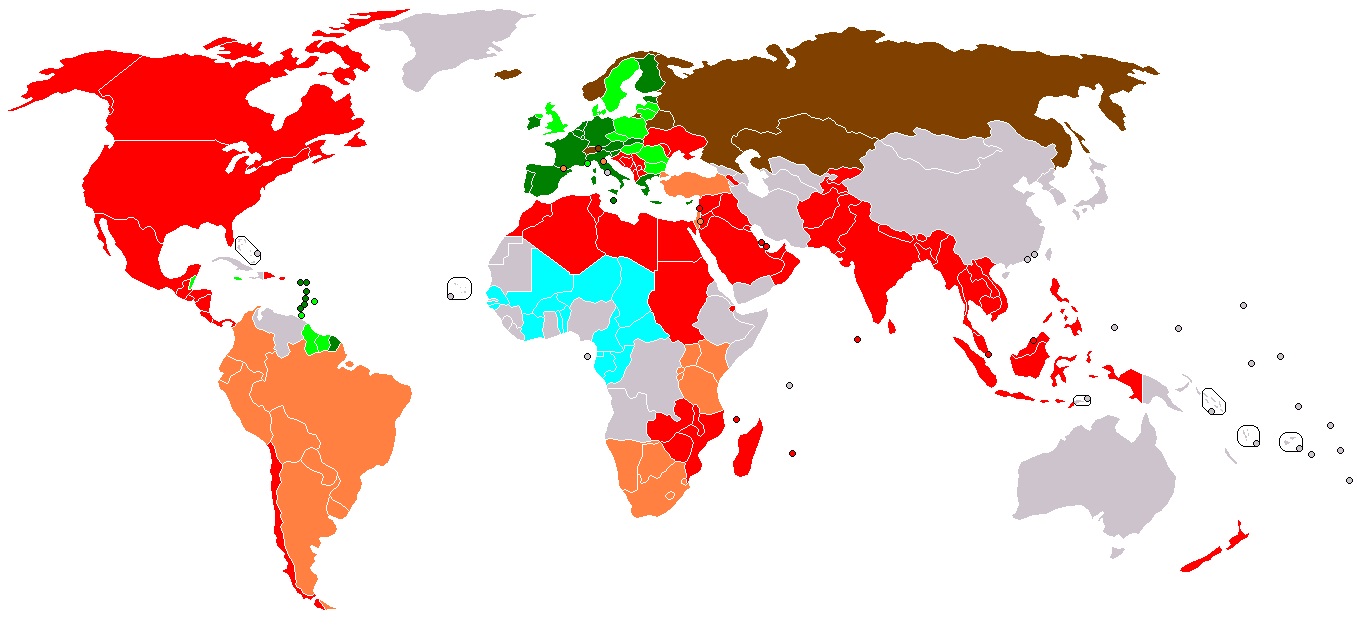

Economic Integration is represented with besides the European Union (today consisting of all European nations Norway, Switzerland and most island economies with autonomy status in Europe excepted), ASEAN (The Association of South East Asian Nations which includes B

EU Member States Population (million): 503.7, GDP per capita PPP USD: 32,644, % World Exports: 32.7 (Source: World Development Indicators 2012, The World Bank, Washington D.C.)

runei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, The Phillipines, Singapore, Thailand and Vietnam), Mercosur (Argentina, Brazil, Paraguay and Uruguay) and NAFTA (Canada, Mexico and the United States). These are the most successful and advanced examples of Economic Integration agreements.

Europe has been the leading template for developing the ideas behind Economic Integration, e.g. with the introduction of concepts such as the process of widening (increasing number of members) and deepening (climbing the ladders) economic integration over time.

The American War of Independence in 1775-83 and the subsequent establishment and division of labour between semi-autonomous States united under a common Federal Government has also served as an important historical template for the process we today know as Economic Integration.

America is the best example we have of a fully integrated economic area among though only states rather than nation states (and historically it is probably important that they never were nation states).

The Steps of Deeper Integration

Economic Integration can best be understood as a process of moving up a ladder. The first step is free trade, the second a customs union (countries adopt the same tariff with the rest of the world), then a common market (shifting emphasis from targeting tariff to non-tariff barriers), then a single market (with a shift towards emphasis on services, labour and/or capital movements), then a monetary union and finally an economic union where there is complete nearness of all institutions and policies that affect the economy.

The latter may in particular be difficult to achieve if countries have or come from very different economic system backgrounds. Differences in national culture may similarly prevent de facto integration from taking place. This is perhaps best exemplified with the lack of de facto integration within nation sates. The divisions and development disparities between the North and South of Italy is an example hereof.

Motivations

Countries may have different motivations about entering into these types of agreements. Only some of these are of an economic nature, others are of political origin.

In this blog I only focus on the economic arguments for why Economic Integration may be a good idea or why some also argue that it could be a less good idea.

Today the Euro crisis which in part is a result of a too fast and ambitious integration process has resulted in some disillusionment with the future of the process. It has even brought to the forefront the possibility that some countries wish to exit the European Union.

In reality this is unlikely to happen and the process has only very rarely been seen to be put in reverse, at least in modern times. All empires have eventually disintegrated, but they were the result of man’s conquests rather than voluntary democratic collaboration among governments and people.

Trade Creation vs. Trade Diversion

In economic textbooks and academic papers the overshadowing debate has been whether Economic Integration serves as a building or stumbling block for the process of global free trade and integration as now governed under the World Trade Organisation.

That is why economists have been so interested in the phenomena of trade creation and trade diversion. This idea was first introduced by the Canadian economist Jacob Viner in the 1950s.

United States of America Population (million): 311.6, GDP per capita PPP USD: 48,112, % World Exports: 8.6 (Source: World Development Indicators 2012, The World Bank, Washington D.C.)

Trade creation is when Economic Integration gives cause to new trade that did not take place before the agreement was entered into. This may happen because previous barriers to trade between the member countries have been dismantled.

Trade diversion happens when countries that enter into a preferential trade agreement end up buying goods and services from each other that could have been produced more efficiently by a country outside the area affected by the agreement.

Pure free trade areas such as NAFTA and ASEAN are more likely to lead to trade creation and less so trade diversion, whereas customs unions such as the European Union and Mercosur are fretted especially by the WTO to lead to inefficiencies in the global trading system due to trade diversion.

Contrasting the data for the European Union and the United States shows that currently the EU is 1.7 times larger than the US in terms of population, but the US population is 1.5 times richer on average. Hence the greater economic weight of the US would suggest that the two areas participate almost equally in world trade.

However, as the data also shows this is far from the case. The EU trades 3.8 times more with the rest of the world than the US! Hence historically the US is a much more self-reliant economy whereas Europe traditionally has been engaged in trade with the rest of the world. Therefore history matters and casts this type of economic theorising somewhat in doubt since the starting point for the analysis will always matter for conclusions in a world of second-best choices.

The Market Size Rational

In reality the motivation for economic integration takes a different starting point. This is based on the economics of industrial organisation combined with international trade theory as exemplified with the work of economists such as Paul Krugman (for a good overview of the application of the New Trade theories to Economic Integration see Chapter 3 in Drud Hansen and Nielsen, 1997).

ASEAN Member Countries Population (million): 604.8, GDP per capita PPP USD: 5,581, % World Exports: 6.9 (Source: www.asean.org and World Development Indicators 2012, The World Bank, Washington D.C.)

The essential argument here is simple and easy to understand. In pure economic terms small countries are disadvantaged mainly because of the smallness of their domestic market. Economic Integration can fundamentally pave the way for an increase in the market size firms can sell to, including breaking up national monopolies more effectively and a potential for better reaping of static and dynamic scale economies by individual firms.

A positive and very important side effect is therefore also that the firms operating inside the integrated market may become more efficient and thereby be able to compete with larger and more efficient firms emanating from other large countries or other economically integrated areas.

This is the reason why ASEAN is growing in importance in South East Asia. However, these arguments or benefits from economic integration also require that the rules of competition are upheld. Without stringent anti-trust laws it is not certain that the benefits of breaking up national monopolies and scale economies can be realised. Competition is a prerequisite for the realisation of all these benefits.

The future of Economic Integration

Comparing the situation in the European Union and ASEAN right now makes it compellingly obvious that the locomotive for deeper integration is and has always been economic growth.

Currently Europe is in a stalemate and the impulse for deeper integration has shifted eastwards to ASEAN.

In Europe deep restructuring may be a necessary step for growth and economic integration to resume. The nearness of the institutions and especially in the South of Europe has not been achieved sufficiently to make the monetary integration process function as smoothly as it was envisioned by Mundell’s theory (Mundell, 1961).

References

- Drud Hansen, J., & Nielsen, J. U. M. (1997). An Economic Analysis of the EU, McGraw Hill, Cambridge.

- Mundell, R. A. (1961). A theory of optimum currency areas. The American Economic Review, 51(4), 657-665.

- Viner, J. (1950). The Customs Union Issue, Carnegie Endowment for International Peace. New York.

Header image: Stages of Economic Integration (CC 3.0). See http://commons.wikimedia.org/wiki/File:Economic_integration_stages_(World).png for details and more information

No comments yet, fill out a comment to be the first

Leave a Reply