March 18, 2015, by Public Social Policy

Isn’t spending on welfare meant to be falling?

By Bruce Stafford, Simon Roberts and Joe Sempik

For all the talk of austerity and welfare cuts, it might be presupposed that spending by the Department for Work and Pensions (DWP) has fallen and will continue to fall in the future. However, the Department’s own figures present a more nuanced and possibly unexpected picture.

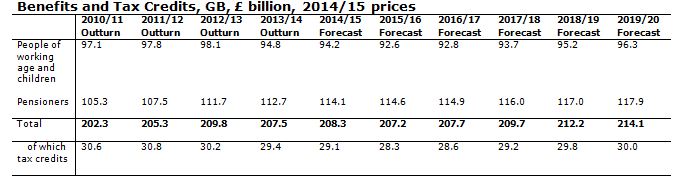

Source: DWP (2015) Outturn and Forecast: Autumn Statement 2014

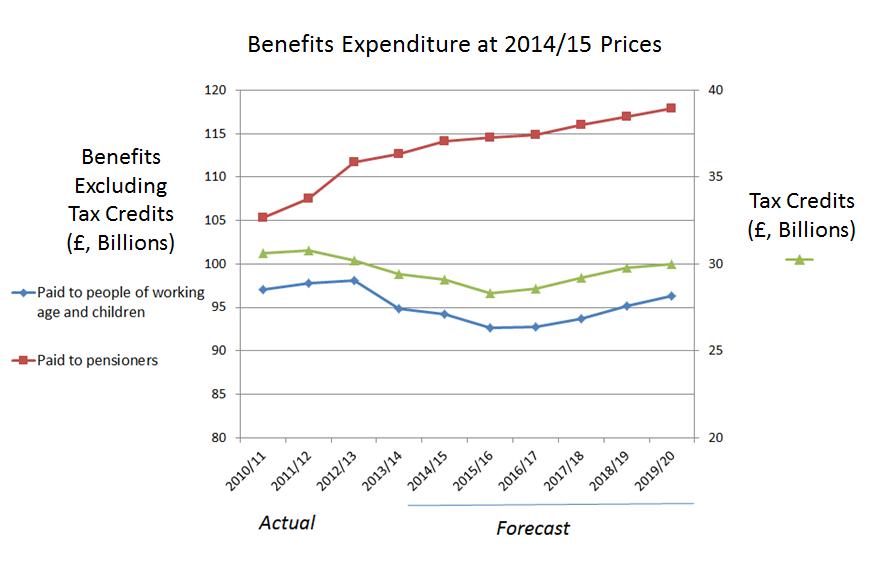

The total benefit and tax credit expenditure in real terms did peak at £209.8bn in 2012/13 and is forecast to fall to £207.2 in 2015/16 (a reduction of only one per cent), but thereafter it is expected to increase, so that by 2019/20 it is £214.1bn.

The Coalition’s plans mean that total benefit and tax credit expenditure is expected to increase by 5.5 per cent between 2010/11 and 2019/20. But this total conceals a significant variation in who will benefit from the spending. Over this period spending on pensioners will increase by 10.7 per cent, whilst children and those of working age will see a fall of 0.9 per cent, with spend on tax credits falling by 1.9 per cent (see graph below). This is in line with recent announcements that benefits for pensioners will be protected post-election. The universal nature of many pensioner benefits means that this protection covers both poor and affluent pensioners.

The estimates do not include George Osborne’s Conservative Party conference announcement that if they win the 2015 general election, there will be a £12bn cut in the welfare budget for 2016-17 to 2017-18 to help eliminate the budget deficit by 2018. To achieve this a future Conservative Government would freeze most working age benefits for two-years, (“saving” £3.2bn by 2017-18); reduce the benefit cap to £23,000; and they would seek to end youth unemployment by giving unemployed 18- to 21-year-olds six months to find work or training before their Jobseekers’ Allowance is withdrawn. Implying that that the proportion of spend on working age benefits will fall to around £81bn in 2017/18. Whether this is feasible let alone desirable is unclear.

No comments yet, fill out a comment to be the first

Leave a Reply