December 18, 2015, by Katharine Adeney

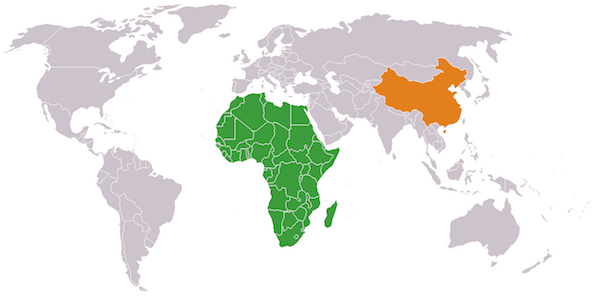

Africa – Is China a competitor or not?

By Celine Herren – MSCi International Relations and Global Issues (2015).

After China opened to foreign investments in the 1970s, its economic growth was to be sustained by capturing new markets and resources. To this aim, China implemented the ‘go out’ policy in 2001. This policy aimed at expanding trade and investments globally by encouraging Chinese state-owned companies (SOEs) to invest overseas and promote domestic labour, technology and products. The policy’s impact on growth has been phenomenal: China’s level of trade grew so fast that in 2012 China became the world’s largest exporter of manufactured goods and the third largest investor in the world. The policy’s particular accent on achieving energy security resulted in most foreign direct investments (FDI) concentrating on commodities and infrastructure. Africa, with its large reserves of raw materials, has not been impermeable to the Chinese force. China’s trade with Africa has grown from $9.5 billion in 2000 to $79.8 billion in 2009, while China’s FDI to the continent increased from 2.6 per cent of the total FDI in 2003 to 9.8 per cent in 2008.

A serious competitor

The ‘China effect’ has both positive and negative consequences for Africa, depending on certain economic conditions. It seems that China has a more positive impact on the economic development of low income countries with the right political and economic context, while China’s interest in securing natural resources may encourage oil-dependent countries such as Angola and Sudan to postpone the development of higher value economic sectors such as manufacturing. In more developed economies, China may act as a serious competitor. Trade and FDI are the main channels of China’s engagement in Africa, although diplomatic relations and aid are important too.

While the coming of competitive Chinese firms and cheap Chinese products has had some negative impact on the local manufacturing sector, it is a formidable opportunity for Africa to gain from skill and technology transfer while these companies provide both employment and cheap consumer goods, impacting positively on living standards and possibly on economic development. In oil-dependent countries, however, evidence suggests that the manufacturing sector shrank as Chinese investment in the primary sector rose. Nonetheless, speaking of China as a force for under-development may be too extreme as China has contributed to the development of the infrastructure of these countries. Moreover, it is often down to governments to set the rules of the game and make sure FDI and trade are channelled towards industrialisation. China is in Africa for business, not to make sure governments take the ‘right’ decisions when it comes to economic development. It is however not unrealistic for these countries to capitalise on their resources and use the primary sector as a drive for their development as other countries have done.

China’s engagement has then brought both opportunities and threats for African economies. China is a serious competitor to African nations. This competition comes at different level: a competitor for Western products on the African markets, a competitor for African products exported to other African or Western countries, a competitor with African products in the local economy, a competitor for local firms and even a competitor for local jobs.

Boosting the African economy

Although local industry suffers from China’s competition, with many small companies driven out of businesses, it forced some restructuring ultimately making the African textile sector more robust. Indeed, to survive firms had to diversify their products and export destinations, turn to more value-added products and invest to increase productivity. The South African textile industry, for example, managed to retain its competitiveness by focussing on fast fashion.

The competition from China also pushed South Africa to shift towards the service sector, which now captures more than half of the total FDI to the country. The rise of the service sector and the decline of manufacturing suggest that South Africa is moving closer towards developed countries in which the service sector dominates all other sectors of the economy. If this is so, South Africa could eventually take the role of a leading ‘goose’ in the continent and, as it moves up the value ladder, the manufacturing sector could relocate to other parts of Africa. Some of this has been seen with Lesotho capturing some of the textile manufacturing.

In conclusion, China can both be a force for development and industrialisation and the exact opposite. Through trade, China has given African economies access to cheap capital as well as consumer goods, which directly improved living standards. Through FDI, China also assists in the development of African economies, upgrading the basic infrastructure therefore providing a base for the manufacturing sector to flourish.

On the other hand, the coming of Chinese construction companies and manufacturers is challenging for local companies who lack competitiveness. Nonetheless, these foreign companies force Africa to innovate and upgrade its skills and technology. The coming of Chinese companies may also act as a role model for the development of local manufacturing firms, thus promoting industrialisation. As China will increasingly be looking for alternatives to Southeast Asia to relocate some of its operations to, Africa should therefore create an enabling environment to capture some of these labour-intensive factories.

All in all, things are moving fast on the African continent and China has a large role to play in shaping the directions that these diverse economies are taking towards sustainable economic development.

Celine Herren graduated with an MSci International Relations and Global Issues in 2015. The dissertation from which this blog is derived won the MA Tomlinson Prize for 2014-15. Celine now works for SGS Hong Kong.

Image is Creative Commons: https://commons.wikimedia.org/wiki/File:Africa_China_Locator.png

No comments yet, fill out a comment to be the first

Leave a Reply