December 4, 2012, by ICCSR

What can Mainstream banks learn from microcredit?

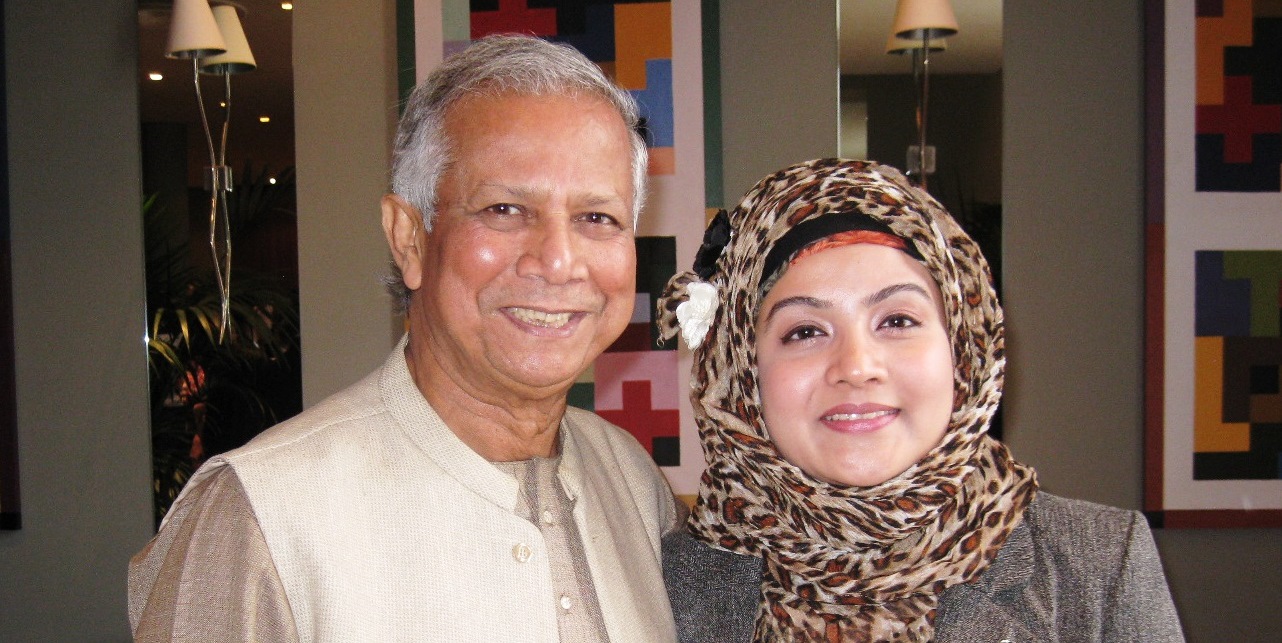

Capital One recently invited members of the ICCSR Team to join them at a breakfast seminar with Muhammad Yunus, Bangladeshi banker, economist and Nobel Peace Prize winner. To tie in with this event ICCSR students were asked to write short reflections on microcredit and the best submissions were invited to attend the seminar. Shakera’s submission was judged to be the winner and is reproduced below (also see the runner up).

——————

What can Mainstream banks learn from microcredit?

Microcredit model has become very popular in developing countries to alleviate poverty by providing micro-loans and market linkages for the poor. As the model is designed for the impoverished borrowers, often considered ‘unbankable’ by the mainstream banks, typically lacking collateral, steady employment and a verifiable credit history, the learning of microcredit can be useful for banks to introduce innovative loan products for marginalised communities, especially in this gloomy economic climate. UK’s key existing microcredit institutions include Credit unions, Community loan funds, Mutual guarantee societies, Social banks etc. which exclude the participation from the mainstream banks. Micro loan products for these ‘unbankable’ groups can bring massive change in the UK banking culture. However, the needs, challenges and opportunities to design the loan products might significantly vary from country to country even from borrower to borrower.

1) Identifying the target group and their need. Prior to developing any loan product it is crucial to identify the target group and their needs. Knowledge of the target population helps to tailor a need driven loan products targeting different borrowers. Mainstream banks can target micro-entrepreneurs with income stability for individual and group loan products. Existing membership or non-membership based associations such as farmers’ association; traders’ association of homogeneous groups can be a valuable entry point for introducing micro-loan programmes. Group loans can also be offered to these entrepreneurs to avail various common amenities, i.e., farmers, as a group, in the nearby areas can buy relatively expensive firming tools and machineries.

2) Savings complementing credits. Frequently, it is experienced that borrowers need savings services along with the credit products. Building a relationship through microcredit can allow banks to provide savings guidance to the borrower that further secure their financial interest. Banks may also collaborate with groups of small businesses (such as Mutual guarantee societies) that pool their savings in banks in order to borrow at better rates of interest.

3) Customise the model. Mainstream banks must realise that the Grameen microcredit model is initiated and designed in the context of Bangladesh considering the borrowing culture and below poverty line target population. Therefore a natural shift from the existing microcredit model is required here which might demand further innovation as well as trial and error. For example, compared to Grameen Bank model where loan products do not include any subsidy from other sources, Indian government have various microcredit schemes subsidising up to 50% of the total loan amount for the borrowers. The rest of the loan is provided by mainstream banks effectively reducing the risk of the banks as well as the burden of the borrowers. Similarly in the UK, existing government subsidy schemes for various target groups (farmers and small scale enterprises) can be explored and linked with bank’s loan products.

In spite of weaker legal and institutional systems, the microcredit model is proven to be a success in developing countries. There is no reason why it should not be successful in western world where institutional arrangements are much stronger! Much depends on the execution, though. Prior to any engagement, it is important to gain knowledge from other country experiences and their sound practices in this regard.

By Shakera Siddiky. Shakera is a doctoral student at the ICCSR, Nottingham University Business School.

[…] Capital One recently invited members of the ICCSR Team to join them at a breakfast seminar with Muhammad Yunus, Bangladeshi banker, economist and Nobel Peace Prize winner. To tie in with this event ICCSR students were asked to write short reflections on microcredit and the best submissions were invited to attend the seminar. Mei-ing’s submission was judged to be the runner-up and her entry is reproduced below (also see the winner). […]

Excellent piece…