June 25, 2020, by lzzeb

Global Biofuel Production Trend: The inevitable energy bio-future for achieving global climate target

A blog by Basiru Shehu Gwandu

My research focuses on exploring locational criteria to optimise biofuel production potential in Nigeria. The research looks into finding most suitable lands in the country for cultivating biofuel crops largely on the basis of ecological requirements of the crops. Then optimise locations for biofuel processing based on the identified suitable lands. As part of the work, in summer 2018, I embarked on field visits to 4 agricultural research institutions in Nigeria that has national research mandate on 5 biofuel crops. These crops are Sweet sorghum, Sugarcane, Cassava, Oil palm and Jatropha. The purpose of the visit was to conduct focus group discussions with field researchers that have expertise on the crops. Selection of these crops for biofuel production in Nigeria could be regarded as right decision considering the global trend in biofuel production as well as the county’s ecology. Most of the bioenergy industry successes recorded around the world were based on bioenergy crops; Maize (US), Sugarcane (Brazil), Sweet sorghum and Cassava (China), Oil Palm (Malaysia) and Jatropha (India). Although there are arguments about their real contribution to climate change mitigation, biofuels release fewer Green House Gases (GHGs) into the atmosphere compared to fossil fuels. Thus, one of the strategies used to ameliorate the environmental concerns of fossil fuels and reduce GHG emission is blending biofuels with petroleum as a transport fuel. Many national energy systems adopted different carbon dioxide policies and reduction targets, culminating into the global climate target. The target involves pursuing an effort to limit global temperature increase to 1.5 degree Celsius above the pre-industrial levels.

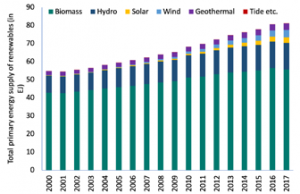

Achieving the global climate target is deemed to be necessary to avert incalculable risks to humanity (Revill and Harris, 2020). The authors opined that this is feasible but only realistically if the global emissions peak by 2020 at the latest. According to Nachmany and Mangan (2018), there can be more detailed accountability for meeting the target by focussing efforts on specific sectors or activities and setting sectoral targets. As seen in their Nationally Determined Contributions (NDCs), sectors mostly targeted by countries are energy, land use, land use change and forestry, and agriculture. Energy is the highest GHGs emitting sector and thus not surprising that it is the most targeted sector in both the NDCs and national laws and policies. According the US Energy Information Administration, the share of transportation sector is 25% of the global energy consumption. Thus, biofuels use continue to expand, particularly in the transport sector. According to the World Bioenergy Association, biofuels contributed 73% of the global non-fossil energy use in transport in 2017 (figure 2).

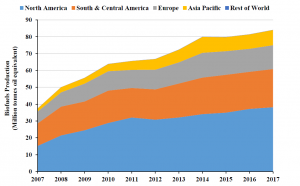

According to Ebadian et al. (2019), world biofuels production from 2007 to 2017 increased at an annual growth rate of 11.4% (figure 3). International Energy Agency (IEA), reported that global biofuel production increased by 10 billion litres in 2018 to reach a record 154 billion litres. This is a 7% year-on-year increase, the highest in 5 years and double that of 2017. The output is forecasted to increase by 25% in 2024, with expected 3% year-on-year annual growth. According to International Renewable Energy Agency (IRENA), bioenergy will account for one-third of global renewable energy by 2050.

However, bioenergy faces challenges such as uncertainties (especially crude oil price uncertainties), political risks and financial challenges. Also, the technological obstacles to commercialising advanced biofuels have proven to be greater than envisioned. Despite all these, biofuel industry continue to expand and its share in global energy consumption continue to increase. Bioenergy created 2.8 million jobs (WBA, 2017), indicating its role in reducing global unemployment rates. Ethanol has grown into a large global market, unlike biodiesel which is less established though supported by policies and incentives. Shell reported use of 9.5 billion litres of biofuels in the petrol sold worldwide in 2018. Some of the determinants of the volume and the direction of the biofuel trade are policies, tariffs, crop yields, feedstock availability and within country biofuel supply and demand (Ebadian et al., 2019). The current major players in liquid biofuels trade are the US, the EU and Brazil.

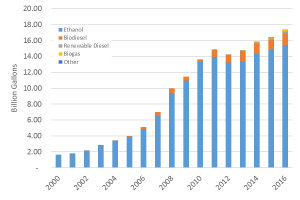

Biofuels production has grown steadily in the US reaching 16.6 billion gallons in 2016 from 14.1 billion gallons in 2012 (EPA, 2018). However, as figure 4 shows, the production increase was relatively slow recently likely due to challenges associated with E10 blendwall (gasoline with 10% ethanol blend). It was suggested in the report that this blendwall need to be expanded to E15 for the ethanol market to expand in the US. The US biodiesel production also reached a record high of 1.56 billion gallons. According to the US Department of Agriculture (https://www.ers.usda.gov/data-products/us-bioenergy-statistics/), ethanol fuel production from September 2018 to august 2019 was over 16.929 billion gallons (approximately 64 billion litres). Biodiesel production for the same period was put at more than 1.724 billion gallons (approximately 6.5 billion litres).

According to the European Environment Agency, renewable energy is growing as a share of the total amount of energy used by the transport sector. Most of this has been from biofuels that meet sustainability criteria since 2011 when the average share was 4%. Across the 28 member states, the average was 7.4% in 2017 and increased to 8.1% in 2018. Sweden’s and Finland’s share of renewable in transport energy was 32.1% and 18.8%, respectively in 2017 (EEA, 2019). In 2018, a target was set that require all the member states to raise the share of renewable energy in their energy consumption in roads and rail to 14% by 2030. The 2011 white paper set an objective for decarbonising transport fuels in aviation and shipping to reach 40% by 2050. According to the USDA, Brazil ethanol and biodiesel production for 2019 is estimated at 34.45 and 5.8 billion litres, respectively. This is up 4% and 8% from the 2018 production, respectively (GAIN Report, 2019). The operation of biofuel programme in Brazil is based on three main instruments. The annual carbon intensity reduction targets, biofuels certification by efficiency in reducing GHGs emissions and the decarbonisation credits.

The contribution of biofuels to GHGs emissions reduction is currently not valued due to the absence of specific carbon decarbonisation market through which biofuels’ environmental benefits could be recognised and remuneration for this recognition could be formalised (GAIN Report, 2019). It could be obvious that there is need for the formalisation of this market considering that bioenergy is still the largest renewable energy source globally (figure 5). It contributes 9% of the global renewable electricity and 96% of the global renewable heat (WBA, 2019). IEA reported that due to an optimistic outlook for bioenergy in power generation, its tracking status was upgraded from ‘more efforts needed’ to ‘on track’.

All renewable options are needed including advanced and conventional biofuels to realise the long-term decarbonisation of end use sectors, especially in heavy transport, shipping and aviation. Stronger policy support and innovation to reduce costs are required to scale up both advanced biofuel consumption and the adoption of biofuels in aviation and marine transport. According to the proposals adopted by ICAO, carbon offsetting will be voluntary from 2020 to 2027 and mandatory afterwards. The goal of the offset is to cover an estimated 65% emissions growth above 2020 levels in the voluntary phase and 80% from 2027 to 2035 (Revill and Harris, 2020). The authors suggested that access to biofuels should be prioritised ahead of other sectors for aviation industry because it currently has no alternative pathway to reach zero emissions. It is projected, under business as usual, that the share of the marine sector in the global emissions will double by 2050 from the current estimate of 1.5%. According to Shell, “biofuels and renewables are keynote energies for meeting mobility demands of the 21st century without creating rampant CO2 emissions. By 2050, three-quarters of humanity will live in a city. Adjusting the energy mix will be crucial to living sustainably and protecting the environment”.

Solid policy framework for low carbon bioenergy is key to drawing investment (Biofuture, 2020). IEA concluded that without substantial increase in modern bioenergy, there is no chance to reaching our climate target. Attainment of the existing potentials require collaborations and collective actions. IEA, IRENA and Food and Agriculture organisation (FAO), agree that sustainable management of bio-economy is possible through parallel increase in food production, smart agricultural practices, better use of rural and urban waste, proper policies and continued development of new technologies.

I would like to close this blog by showing my sincere appreciation to my sponsor, the Petroleum Technology Development Fund (PTDF) for providing the funding, my place of work, the Agricultural Research Council of Nigeria (ARCN) for granting me the study leave, the supervisors, Professor Michèle L. Clarke and Dr. Gary Priestnall for their continued supervisory support and the University of Nottingham for providing the enabling environment.

No comments yet, fill out a comment to be the first

Leave a Reply